| CLIENT | INDUSTRY | PERIOD |

|---|---|---|

| A large Insurance company in Thailand | Life Insurance | Nov ’18 - Jul ’19 |

This case study includes 2 of the change Projects identified as part of outcomes of Diagnostic Review and Recommendations For a New Operating Model project.

FUNCTION

Underwriting

OBJECTIVES

Simplify Underwriting Processes and improve Automated Underwriting for Mortgage Assurance product.

Improve Productivity for Underwriting Team of Ordinary Life, Unit Linked products and rationalize Underwriting support staff for all products.

WORK DONE

Analysed the existing Underwriting processes and rules for in-scope products.

Utilized Machine Learning to analyse data pertaining to review of Medical Insurance Bureau (MIB) cases.

Simplified and standardized Underwriting rules for in-scope products.

Implemented the new rules in the policy administration system through system enhancements.

Simplified Medical grids for in-scope products. Reduced the number of medical grids from 14 to 5.

Implemented the new Medical grids in the policy administration system through system enhancements.

Designed and implemented simplified Underwriting processes and checklists.

Eliminated non-value adding activities performed by support staff.

Rationalized the supervisory and support team’s structure.

Implemented productivity enhancement measures for the Underwriters.

KEY OUTCOMES

Note: Performance metrics improvements are based on comparison of 2 months’ data post implementation of changes with the baseline data gathered before the Project.

| CLIENT | INDUSTRY | PERIOD |

|---|---|---|

| A large Insurance company in Thailand | Life Insurance | Nov ’18 - Jul ’19 |

This case study includes 3 of the change Projects identified as part of outcomes of Diagnostic Review and Recommendations For a New Operating Model project.

FUNCTION

New Business Operations

OBJECTIVES

Move to a simplified and semi-automated New Business process for Mortgage Assurance product.

Move to a simplified New Business process for Ordinary Life, Unit Linked products.

Conceptualize, plan and design the e-Policy solution.

WORK DONE

Implemented a simplified and standardized end-to-end process for New Business Operations for the in-scope products.

Standardized the customer documents checklist and implemented the same across touch-points.

Designed and implemented a simplified Data verification process based on Risk Based Sampling.

Eliminated non-value adding activities of the Sales support team.

Rationalized the supervisory and support staff structure.

Designed the e-Policy delivery solution, end-to-end processes to support its implementation and developed the documentation for regulatory filing. The implementation of this change is being taken up by the client.

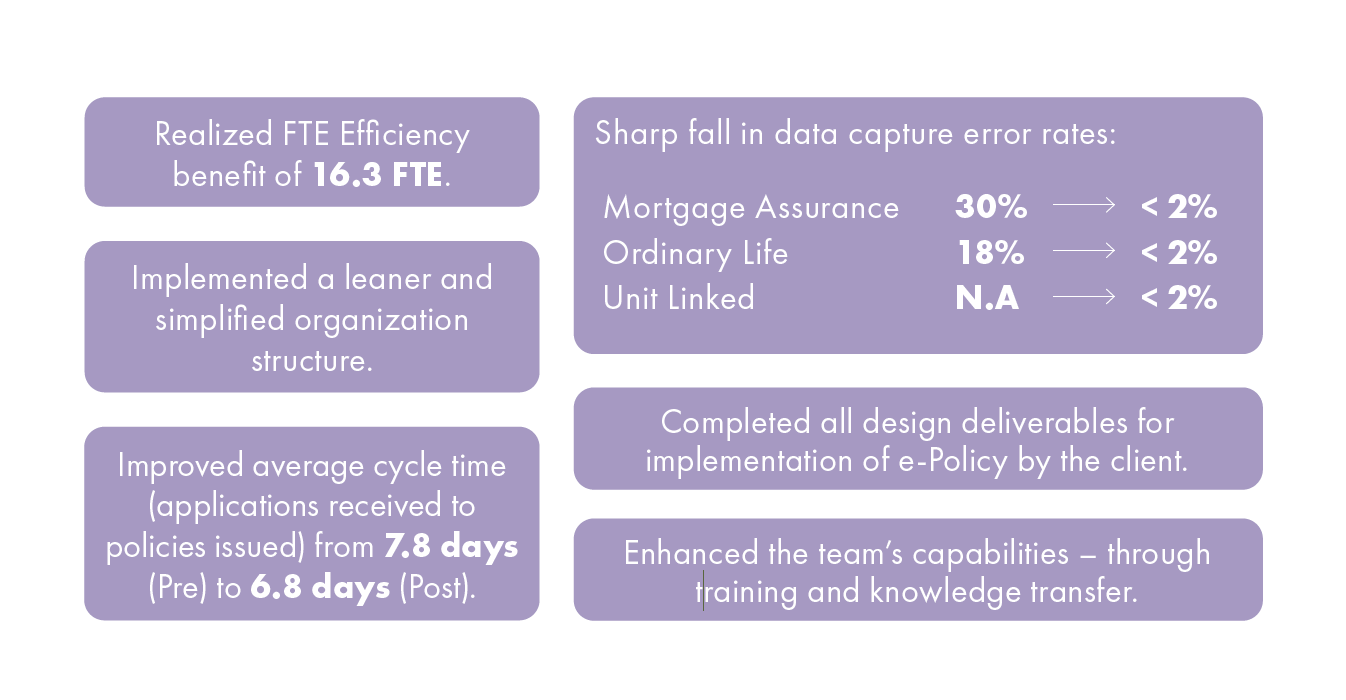

KEY OUTCOMES

Note: Performance metrics improvements are based on comparison of 2 months’ datapost implementation of changes with the baseline data gathered before the Project.

| CLIENT | INDUSTRY | PERIOD |

|---|---|---|

| A large Insurance company in Thailand | Life Insurance | Nov ’18 - Jul ’19 |

This case study includes 3 of the change Projects identified as part of outcomes of Diagnostic Review and Recommendations For a New Operating Model project.

FUNCTION

Customer Service, Premium Collection

OBJECTIVES

Improving the productivity of Customer Services team handling Inbound calls and reducing the volume of non-value adding calls.

Instant premium payments, process simplification and back-office automation of Premium Collection activities.

Optimize premium follow-ups, rationalize team capacity and managerial structure in Premium Collection.

WORK DONE

Aligned the Inbound Call Centre shifts schedule with the daily, weekly and monthly Call arrival pattern.

Designed and implemented SMS notifications, SMS reminders for premium payment closer to the premium due date.

Implemented operational improvements in handling of inbound calls from customers and sellers.

Rationalised the supervisory and managerial structure at Inbound Call centre.

Eliminated the entire premium follow-up function being a non-value adding post implementation of 2.

Automated download/upload of Billing and Premium Collection files for identified processes.

Rationalized the capacity of Premium Collection team.

Rationalized the Managerial span of control for Premium Collection

KEY OUTCOMES

Note: Performance metrics improvements are based on comparison of 2 months’ data post implementation of changes with the baseline data gathered before the Project.